Whereas our previous post focused predominantly on the ways in which hybrid working might influence the size of the office footprint, this post asks what kind of spaces people will seek out when they return to the office. There is a growing chorus of analysts projecting a shift towards collaboration and socialization spaces in the office, with some companies already in the process of redesigning and optimizing their office space to accommodate this change.1

While there are good reasons to embrace collaboration and to expect an increase in demand for group spaces, there are also valid reasons to take a more cautious approach. Before transforming the entire real estate portfolio, companies might benefit from closely monitoring actual usage information to see where employees are gravitating in the reopened office.

Optimizing office space for a collaborative future

The rationale underlying predictions of a collaboration-focused workplace is quite straightforward. While research undertaken throughout the pandemic revealed that employee productivity remained high or even increased for many types of tasks, one of the most challenging activities to perform remotely is collaboration and similar creative group activities.

In an assessment of the remote potential of 2,000 activities, McKinsey identified teaching, training, and coaching, as well as providing advice, thinking creatively, and communicating with colleagues as activities for which there was a disproportionate productivity loss from remote work2. Employee surveys appear to confirm this finding: Survey results by JLL, for example, suggest that 70% of employees see the office as preferable for team-building activities3, while PwC found that 87% of employees see the office as important for collaboration4. Anecdotal evidence from many companies points to a fear that a lack of “creative collisions” could slow the pace of innovation.

These findings strongly support the idea that the office should provide a physical environment that fosters interaction, whether that means designing spaces to increase the probability of running into colleagues or providing more group spaces for purposeful interaction.

Is the office just for collaboration?

While such a vision makes intuitive sense, it also ignores several factors that could slow or prevent such a transition. First, many employees continue to signal that they are nervous about returning to the office for health and safety reasons. Anecdotal evidence also suggests that many workers are experiencing newfound social anxieties5. While these may be short-lived reactions to office re-entry, employees may be more wary of working in larger groups for some time or may have different expectations of how much space they need to feel comfortable or productive. Even when employees do seek out collaboration spaces, they might gravitate towards different collaboration spaces than managers expect, choosing smaller huddle rooms over larger conference rooms or vice versa.

A second reason why a wholesale shift towards open, collaborative offices might not perform as expected is that it relies on the assumption that employees can effectively conduct focused, individual work at home. However, surveys have found that workspace quality and the level of distractions in the home environment is highly variable. There is a substantial contingent of workers for whom the home environment does not provide good support6 and who may actually need the office for quiet, focused work.

Crafting an office space configuration strategy

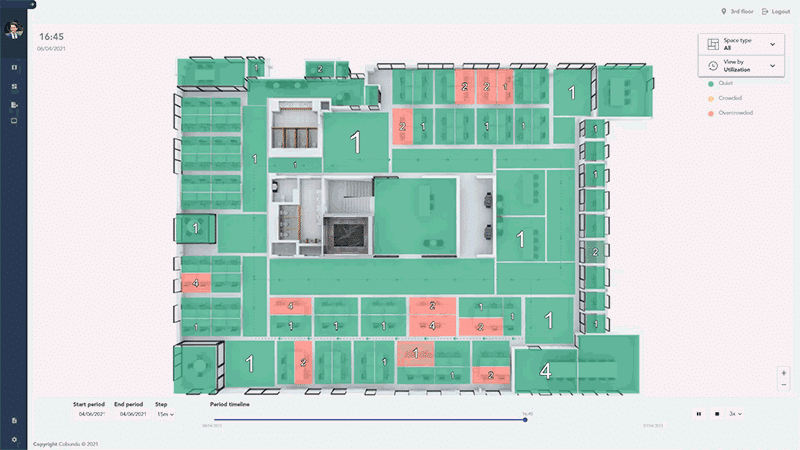

Rather than optimizing office space by redesigning offices to respond to forecasts about dramatic changes to the office, another approach to office configuration is to focus on data trends. While some office space reconfigurations certainly make sense, companies might also benefit from a more gradual approach in which they monitor both occupancy and utilization of different types of spaces available in the office in order to align supply and demand for space over time.

The objective of such a strategy would be to identify spaces that are over- or underperforming on either occupancy (whether or not spaces are being used), utilization (how close to capacity they are being used), or both. In this way, managers can identify which spaces are being under- or over-provided and make adjustments over time to optimize the way space is being used. This deliberative approach provides greater transparency about decision-making, ensures that companies are not rushing into significant investments that might not reflect their workforce, and allows for tailored space strategies to develop across different locations, reflecting the specific needs of those offices.

This post is part of a blog series about the way hybrid workplace solutions can facilitate changing ways of working in the post-pandemic office.

- Hughes, Owen (03/02/2021). “The office still matters. But it’s going to look very different when you get back” TechRepublic. Online. https://www.techrepublic.com/article/the-office-still-matters-but-its-going-to-look-very-different-when-you-get-back/ McKinsey found that as many as two-thirds of survey respondents expected to make this shift and reduce office space. McKinsey (11/5/2020). McKinsey Global Pulse survey; McKinsey Corporate Business Functions Practice, “Reimagine: Preparing for SG&A in the next normal.” Online.

- McKinsey (02/2021). “The Future of work after COVID-19), Online. p. 39.

- JLL (01/2021). “Reimagine: The new future of work to shape a better world”

- PwC (01/2021). “US Remote Work Survey” Online.

- Julie Creswell and Peter Eavis (04/02/2021). “Returning to the Office Sparks Anxiety and Dread for Some” New York Times https://www.nytimes.com/2021/04/02/business/office-remote-work-anxiety.html

- See Leesman (2021). “Your workplace of the future” and Microsoft (2021) “The New Future of Work” Chapter 5: Devices and Physical Ecosystems.